Survey of PE and VC lawyers finds 74% of “fixed fees” are not so fixed

A key value proposition behind fixed fees is predictability. This sounds good in theory, but it doesn’t always work well in practice.

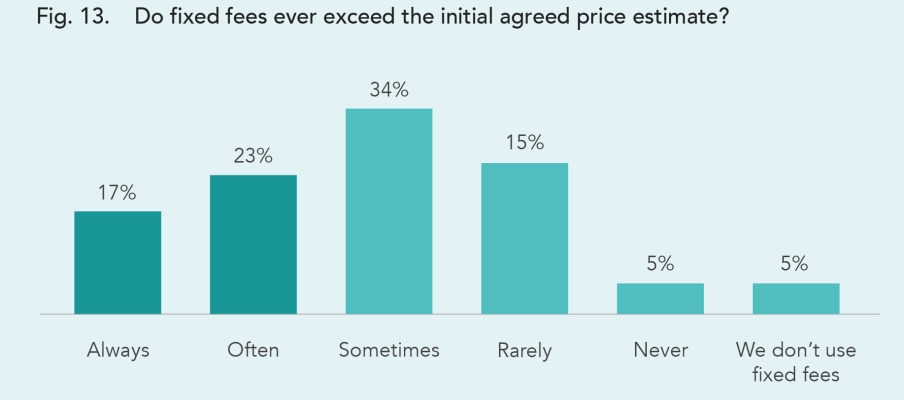

Our recent survey of 300 lawyers working in-house for private equity and venture capital firms found nearly three-quarters (74%) say fixed fees exceed the agreed price at least some of the time.

What’s more, about four in 10 respondents say this happens “always” (17%) or “often” (23%).

Why does this happen?

Many respondents wrote open-ended comments to provide context. Here is a representative sample of responses:

- “Because extra work is necessary to gain a whole picture.” ~ associate general counsel in private equity

- “Things increase unexpectedly or not realizing fully what is required.” ~ chief counsel in venture capital

- “We don’t price it [matters] accurately.” ~ legal partner in private equity

- “We agree on a course of action, and they must advise us if it incurs extra costs before proceeding.” ~ senior legal counsel in private equity

- “Hidden fees.” ~ principal legal officer in private equity

- “They exceed the legal initial agreed price estimate weekly. It’s very hard for my business.” ~ deputy general counsel in private equity

- “I'm not sure but I'm working on finding the answer.” ~ senior legal counsel in venture capital

Fixed fees can create a zero-sum game

Fixed fees can be effective in certain circumstances, but they are not a panacea. There are several reasons for this as our CEO co-wrote with Denton’s for Bloomberg:

- Fixed fees push all the risk onto the law firm in the event a matter proves more complicated once the firm starts digging into the matter.

- Just like the billable hour, fixed fees can induce undesirable behaviors. An unprofitable matter provides an incentive to cut corners or to push work down to under-qualified staff.

- While clients find the notion of fixed fees desirable, few actually demand such pricing in practice. Many grew up in law firms keeping time, so the billable hour feels more familiar than fixed fees.

Lastly, fixed fees can create a “zero-sum game” that puts clients and law firms at odds. This is because if the final price is over or under the fixed fee, either the law firm or the investment firm “wins.” This survey suggests that this happens most of the time with fixed fees.

* * *

The complete survey report is freely available for download here: The pursuit of control in legal spending.