How to save legal costs across the portfolio

Private equity legal teams are in a unique position, often responsible for buying legal services that are one of the top costs for the management company, while also delivering critical results for deal and fund teams. Managing legal expenses across your portfolio, in addition, can seem a daunting task—but it’s a powerful way you can leverage your relationships to add value to the entire portfolio.

What if there was an efficient way for a small legal team to achieve this? A way to optimize legal spend, save the management company money and maximize the value you're getting from your legal operations across all your portfolio companies as well?

In this blog, we'll explore practical, actionable strategies that help you save on legal costs across your entire portfolio.

Let’s dive in.

Mastering legal spend in private equity: Leveraging your scale

It’s fair to say Private Equity (PE) firms are outsized buyers of legal services. Due to the nature of fast-paced and complex M&A work, and specialized fund work, PE teams will often engage specialist teams at top global law firms in large, complex matters.

This results in significant legal spend.

The best legal teams ensure they are managing their firms strategically to get the upside of this high spend volume. But how do you stay on top of this for house, deal, and fund work—never mind the portfolio spend?

Spoiler—there’s a better way.

Private equity firms can leverage their substantial scale to optimize legal costs. As major consumers of legal services, these firms wield significant bargaining power, enabling them to:

- ✅Negotiate more favorable rates with law firms, who are eager to secure the firms' substantial and ongoing business.

- ✅Agree discount structures with their firms that reward them for the share of spend.

- ✅Intelligently leverage alternative fee arrangements (AFAs) such as fixed fees or capped rates, enhancing predictability in legal spending and aligning interests with law firms for cost-effective legal management.

By capitalizing on their clout as major clients, private equity firms can strategically approach legal spend in innovative ways:

- ✅Legal teams can set and manage expectations on the quality of work and other KPIs

- ✅Legal costs, often viewed as opaque expenses, can be transformed into an area for optimization and value creation through astute negotiations and better collaboration.

The best legal teams in PE are also keeping an eye on the spend across the portfolio, and ensuring that both the portfolio companies and the GP are seeing the benefit of well-managed law firm relationships.

The bottom line? Through a deep understanding of the dynamics at play, private equity firms can leverage their scale to master legal spending, turning the legal team from a significant cost center into a strategic advantage across the business and the entire portfolio.

The challenges facing private equity firms

As a CFO or General Counsel in the private equity world, managing legal costs is no easy feat. From lack of transparency to patchy spend data, the challenges can seem insurmountable. But understanding these hurdles is the first step towards overcoming them.

Challenge 1

One of the biggest obstacles is the unpredictable nature of legal fees. With costs fluctuating based on market dynamics and matter specifics, budgeting and financial planning become a guessing game. Just when you think you've got a handle on costs, another invoice pops up for a deal completed months ago.

Challenge 2

If managing legal spend for a single entity is tough, this amplifies when multiplied across an entire portfolio of companies. With each firm potentially engaging different law firms under unique terms, getting a consolidated view of expenditures is challenging. Inconsistent billing practices and varying rates for different portfolio companies only complicates matters further, obscuring spending patterns and making it nearly impossible to identify areas for savings.

Challenge 3

Reviewing every legal invoice line-by-line just isn't feasible. The sheer volume of transactions and the need for swift execution mean inefficiencies and unnecessary costs can easily slip through the cracks. Without a streamlined process for tracking and analyzing spend data, firms risk racking up higher legal bills that eat into investment returns.

While the challenges are daunting, they're not insurmountable.

By enhancing spend transparency and taking a strategic approach to legal resource management, private equity players can regain control and unlock significant savings opportunities.

But it all starts with recognizing and understanding the core obstacles…

Real-time reporting for better financial planning

As the saying goes, knowledge is power. When it comes to legal spend, comprehensive reporting allows for better financial planning because it enables you to look back at historical data and predict spend, as well as capture costs in real-time. Imagine having detailed breakdowns by cost type, firm, and portfolio company.

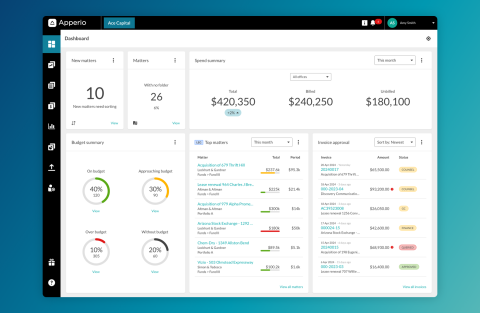

Like in this example:

But the insights don't stop there. Regular reporting allows you to:

- Identify cost-saving opportunities by spotting trends and areas of overspending

- Leverage economies of scale by consolidating services

- Negotiate from a position of strength with real spend data across the whole portfolio

- Allocate resources strategically based on performance vs. budget

- Ensure that all areas of the business and portfolio are benefiting from preferential rates and billing terms

With this kind of reporting, firms become more proactive with legal spend management for better financial health. And this is where smart tech comes in.

📘Keen to learn more about budgeting? Read: How to prevent legal spend running over budget

Accessing data-driven legal spend management

Bold statement: Private equity firms can no longer afford to manage legal costs through guesswork or outdated methods (regulatory trends alone are a strong enough reason). The solution? Powerful technology designed to put data—and control—back in your hands.

Here’s why:

One-click insights 🖱

Imagine having a centralized dashboard delivering real-time visibility into legal spend across your entire portfolio. Advanced legal spend management software accomplishes just that, consolidating data that was previously siloed across multiple firms and entities. All presented in easy-to-read charts, accessible to all.

Automated expense tracking 📌

With automated expense tracking, categorization of spend types, and budget threshold monitoring, these smart solutions streamline processes that were once manual and prone to error. Say goodbye to endless spreadsheets and complex calculations.

Negotiation power 🤝

But the benefits don't stop at internal efficiencies. When it comes time to negotiate with law firms, data-driven technology gives you a massive competitive edge. Armed with detailed historical analyses and benchmarking, you can approach rate discussions from an authoritative position backed by data to secure favorable agreements. When you factor in all your spend, you can ensure that all areas of the business are getting the best value.

Greater efficiency 🚄

Perhaps the biggest win? The time and cost savings achieved through automated processes. By reducing administrative overhead and human error, legal spend management technology allows your team to focus on higher-value tasks that drive bottom-line impact.

To sum up: With data-driven legal spend management insights, you can optimize spend and future-proof financial strategies.

Let’s look at a real-world example to show how this works in practice.

Case study: Getting control of legal spend

Epiris invests in UK businesses with an enterprise value of between £75m - £500m. Frustrated in the past by a lack of clarity and understanding over what the firm would be paying for in legal fees, Epiris’s Chief Investment Partner sought a solution.

With legal fees ranging from between £500,000 to £1m per transaction, Epiris needed a better way to manage costs much more proactively.

Epiris began using Apperio in 2018 and has found this to be a crucial tool in helping internal investment and finance teams to understand legal spend in greater detail and manage the external matters currently in progress.

📘Read the full case study here.

Best practices to secure better legal rates

While legal costs may be high for private equity firms, they can be used to your advantage. As major buyers, you can negotiate better rates and optimize long-term spend management:

#1: Strength in numbers

Negotiation starts with consolidation. By pooling legal needs across your entire portfolio, you go from a single buyer to one with a high-volume, long-term partnership—very enticing for outside counsel.

#2: Data-backed demands

But negotiating better rates requires evidence. You need data to back up your requests. That means compiling:

- Detailed historical spend analysis

- Industry benchmarking

- Forecasted legal budgets and needs

This data allows you to justify desired rates and fee structures.

#3: Value-based fees

Speaking of fee structures, one of your biggest leverage points is moving beyond the billable hour trap. Propose value-based arrangements like:

- Flat fees for routine matters

- Success-tied fees for transactions

- Bundled legal packages spanning multiple needs

With fee models aligned to your business outcomes, you're incentivizing efficient service delivery—it's a win-win.

#4: Long-term partnerships

Law firms crave stability and predictable revenue streams. By offering long-term partnership opportunities with rate locks, you're bringing tremendous value to the table. Leverage that to your advantage and secure preferential pricing.

#5. Regular review and adjustment clauses

But it doesn’t end there. Including clauses in contracts allows for regular adjustments based on performance metrics and actual spend. This ensures that the agreements remain fair and cost-effective over time.

The bottom line? Private equity firms need a holistic view of legal spend across the entire portfolio for better insight and stronger negotiations. It allows firms to:

- Identify spending patterns and areas for improvement

- Streamline processes for efficiency and consistency

- Enforce uniform billing guidelines and compliance

This allows for significantly reduced costs—without compromising on service quality.

Key takeaways: How to save legal costs

We’ve covered quite a bit of ground in this blog so let’s recap the key points:

- Leverage scale to negotiate better deals across house, deal and fund work, and ensure the portfolio benefits as well.

- Managing portfolio legal spend is challenging due to lack of visibility, unpredictability, and fragmented data—but tech can automate this for you to give you back control.

- Detailed financial reporting and analysis of legal spend are crucial for identifying savings opportunities.

- Legal spend management technology provides centralized data, automated tracking, and insights for optimization.

- Consolidate needs, use data for negotiations, explore value-based fees, and propose long-term partnerships with review clauses.

- Effective legal spend management is not just about cutting costs, but maximizing value and enhancing the overall financial health and competitiveness of the firm.

The next steps are clear for forward-thinking CFOs and General Counsels. By embracing the potential of strategic legal spend management, you're not just optimizing today's processes—you're future-proofing your firm's sustained profitability.

Ready to take the next step? If you’re keen to save legal costs across your portfolio, look no further. At Apperio, we enable firms to gain cost control with real-time insights—all delivered in a simple reporting dashboard. Book a demo here to learn more.

Keen to learn more legal spend management best practices? Take a look at these blogs: