Legal spend management: 5 major headaches resolved 💪

Managing legal expenses is notoriously tricky. Unpredictable legal fees and clunky billing processes can mess up your financial planning, slow down operations, and leave the legal team holding the bag.

But what if you could turn these frustrations into an advantage?

With the right technology, you can automate your accruals process, forecast costs accurately, and streamline your billing process. This helps you make well-informed decisions and protects your firm's finances from unexpected legal costs.

Sounds good? In this blog, we'll look at five common legal management pain points businesses like yours face, and show how modern tech solutions can tackle them head-on.

#1. Legal spend management headache: Unpredictable legal costs

Unexpected costs can wreak havoc on your financial forecasting, turning strategic planning into guesswork. When legal fees suddenly spike, it can impact your entire budget and also make a headache for your finance team.

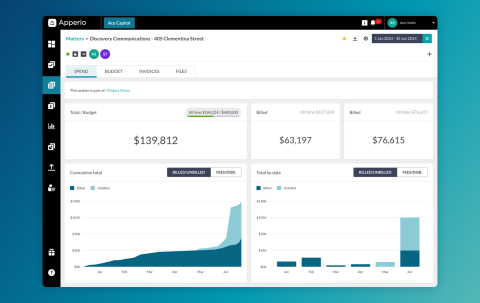

💪Fix: Fortunately, proactive legal spend management technology is changing all this. By automating accruals and WIP visibility, you can prevent surprise invoices and get better forecasts of legal expenses based on historical data and trends. This insight allows you to set and manage realistic budgets and allocate resources more strategically.

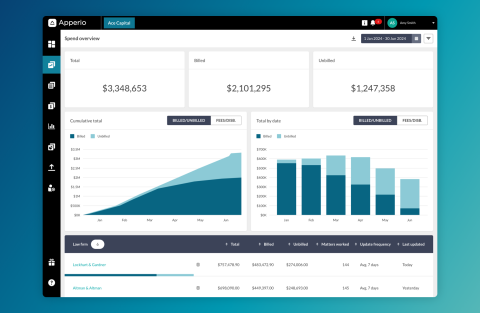

What’s more, these platforms offer sophisticated spend control tools that enable real-time tracking of legal expenditures. You can monitor spending as it occurs, track it against your budget, and adjust projections to maintain financial stability. This level of control tackles the chaos of unpredictable costs and empowers data-driven decision-making to protect your firm's financial health.

#2. Legal spend management headache: Inefficient billing processes

Inefficient billing processes are more than just an inconvenience—they drain resources and time, and create friction in relationships both internal and external. For instance, traditional billing methods often involve email threads, multiple chasers and inscrutable PDFs, leading to delayed invoices that disrupt cash flow and financial planning. These delays are compounded by the risk of human error, resulting in costly discrepancies that require even more time and effort to resolve.

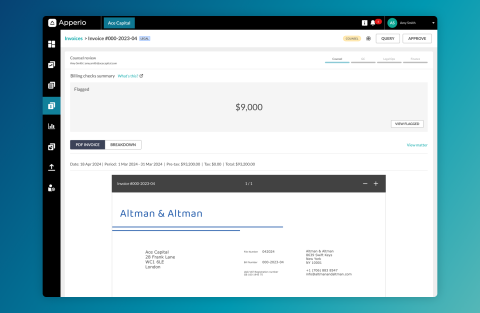

💪Fix: Enter automated billing systems—a key feature of modern legal spend management solutions. These systems modernise how legal teams handle legal invoices by automating the entire process. Automatically routing invoices, checking them for errors or billing guideline violations, and then a simple approval workflow through to payment.

The benefits are substantial. You can achieve huge time savings for your valuable legal team, and eliminate wasted time digging through inboxes to find invoice trails. Rather than having to comb through long PDF invoices, you can automate their review and approve them with confidence.

#3. Legal spend management headache: Lack of transparency

When you can't see how matters are being worked by your law firms, it's very difficult to be confident in the value they are delivering. And it makes it tricky to identify issues before they become a point of contention. On top of this, the lack of visibility also complicates financial oversight and forces teams to rely on manual accruals processes which are slow, painful, and inaccurate.

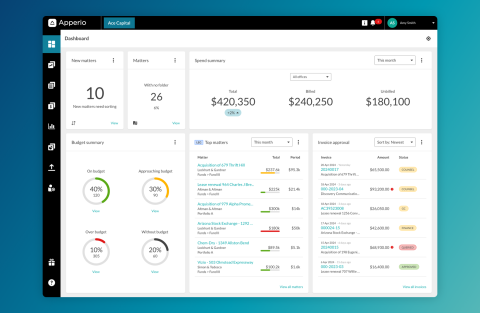

💪Fix: Modern legal spend management technology addresses this challenge by providing a clear view into all your spend and matter detail. Real-time dashboards and detailed reporting features shine a light on real-time costs and help you deeply understand the value the work represents. These tools also allow you to align with your firms on what ‘good’ looks like, ensuring close collaboration and deeper partnerships.

#4. Legal spend management headache: Audit and compliance

Compliance is crucial, both for meeting regulatory requirements and maintaining operational integrity and reputation. The complex regulations governing legal processes, coupled with the need for meticulous record-keeping for potential audits, make compliance a daunting task when using outdated or manual systems. Often, finance teams are required to put together complex accrual models to show where spend has come from and which period it originated in.

💪Fix: Modern legal spend management software automates the accruals process by capturing the data at source. This removes the manual workload of gathering the data and ensures its accuracy while making the audit process a breeze.

Side note: Apperio is the only software provider that does this.

By using legal spend management systems, companies can build robust and efficient audit processes to save time and safeguard from risk.

#5. Legal spend management headache: Data management and integration

At best, data is often scattered across various platforms and systems, making it difficult to bring together and analyze effectively. At worst, it is trapped in numerous spreadsheets. The result is not just inefficiency and inaccuracy but also missed opportunities to use this data to drive value for the organisation. Additionally, integrating this data with existing systems can be daunting due to compatibility issues and complexities in ensuring data integrity during transfer.

💪Fix: Legal spend management tech solutions have modernized how firms approach these challenges. The best systems are built with integration as a core feature, designed to seamlessly connect with a variety of existing IT infrastructures. This compatibility eliminates technical barriers that traditionally hindered data integration, ensuring a smooth flow of information across platforms, and a complete picture of your legal operations.

Furthermore, these advanced tools enhance data management by automating the collection and organization of legal data. They provide powerful analytics capabilities, turning raw data into actionable insights. With improved accessibility and utility, legal data becomes a strategic asset rather than a burden. This means you can quickly access precise information, from historical spending patterns to performance metrics, facilitating better-informed decision-making and more robust planning.

Fixing legal spend management: Key takeaways

We've explored how legal spend management tech tackles key challenges for investment firms:

- Unpredictable costs? Predictive analytics forecast expenses accurately.

- Inefficient billing? Automation streamlines invoicing and payments.

- Lack of transparency? Real-time dashboards provide clear visibility.

- Compliance woes? Automated documentation ensures adherence.

- Data struggles? Seamless integration and powerful analytics unlock insights.

Implementing these solutions equips you with tools to streamline operations, reduce errors, and make data-driven decisions—alleviating administrative burdens while boosting oversight.

With the ability to tailor the tech to your specific needs, legal spend management enhances your capabilities. It transforms legal expenses from a cost center into an asset.

Ready to take the next step? If you’re keen to explore legal spend management, look no further. At Apperio, we enable firms to gain cost control with real-time insights—all delivered in a simplified reporting dashboard. Book a demo here to learn more.

Keen to learn more legal spend management best practices? Take a look at these blogs: