The pros and cons of legal invoicing and e-billing software

Legal invoicing and e-billing software promise to simplify billing and reduce administrative burdens. But does it give legal teams the control they need over their external spend?

For many corporate and private equity legal teams, the answer is no. While automation helps speed up invoice approvals and ensure billing consistency, it doesn’t stop budget overruns or provide the continuous visibility of spend needed to prevent them. By the time an invoice arrives, the work is done, and the costs are already locked in.

Without live oversight, this can lead to unexpected budget overruns, strained relationships with finance teams, and costly disputes with law firms. So, the real challenge goes beyond processing invoices more efficiently. The actual issue is controlling legal spend before it reaches the invoicing stage. And this is something legal invoicing and e-billing software struggles with.

This blog covers the strengths and blind spots of legal invoicing and e-billing software and what legal teams can do to gain true oversight of their external legal spend—before costs spiral out of control.

The pros: Why legal invoicing and e-billing software improves billing workflows

For legal teams managing high volumes of invoices, legal invoicing and e-billing software removes friction from the billing process. It automates approvals, enforces consistency, and reduces the administrative burden of chasing, reviewing, and processing invoices manually. While it doesn’t solve spend control challenges, it does bring valuable operational efficiencies.

✅Faster processing, fewer bottlenecks

Automation eliminates the need for manual invoice reviews, significantly reducing the time legal teams spend approving invoices. This helps in-house teams stay focused on higher-value work instead of being bogged down by billing admin.

✅Billing consistency

E-billing software ensures that all law firm invoices follow standard fee structures, billing formats, and agreed-upon guidelines. This minimizes errors, reduces disputes, and improves the accuracy of legal spend data.

✅Improved compliance

Legal invoicing and e-billing tools help teams track rate agreements, enforce outside counsel guidelines, and flag potential breaches. By catching non-compliant billing practices early, legal teams can ensure that invoices align with pre-agreed terms.

✅ Speedier payments

Automating invoice approvals helps avoid unnecessary delays in payments, ensuring law firms are paid on time. This not only strengthens relationships with outside counsel but also prevents any disruption to ongoing legal work due to payment disputes.

For teams handling large volumes of legal invoices, these efficiencies are valuable. But, while invoicing software makes billing smoother, it doesn’t solve the bigger challenge of controlling legal costs before they spiral.

The cons: Why e-billing software alone doesn’t prevent budget overruns

Despite its benefits, legal invoicing and e-billing software has a fundamental limitation: it’s reactive, not proactive. Invoices arrive after the work is completed—by then, any budget overruns have already happened.

❌Invoices arrive too late to change course

By the time an invoice lands, the work is done, and the costs are locked in. If a matter has exceeded its budget, legal teams have little recourse other than disputing fees after the fact—which can strain relationships with law firms and create additional administrative burdens.

❌Billing errors aren’t the biggest budget risk (scope is!)

Many legal teams focus on catching incorrect billing entries, but the real issue often lies in how legal work is resourced. Invoices don’t highlight inefficiencies like too many timekeepers on a matter, excessive senior lawyer involvement, or duplicate work—all of which can quietly push costs beyond expectations.

❌No visibility into the true cost drivers

When a matter runs over budget, invoice data alone won’t explain why. Were additional timekeepers added mid-matter? Did unforeseen complexities arise? Were billable hours used inefficiently? Without a way to track costs in real-time, legal teams lack the insight needed to prevent repeat overspending in future matters.

If e-billing software alone isn’t enough to control legal spend, what is? The answer lies in switching from invoice-driven tracking to continuous oversight. Let’s look at how proactive spend monitoring can be used in practice.

Beyond invoices: How legal teams can get ahead of costs

Legal teams that rely solely on invoicing software often find themselves stuck in a reactive cycle—reviewing invoices, disputing unexpected charges, and struggling to control spend retroactively. But by the time an invoice arrives, it’s too late to prevent budget overruns.

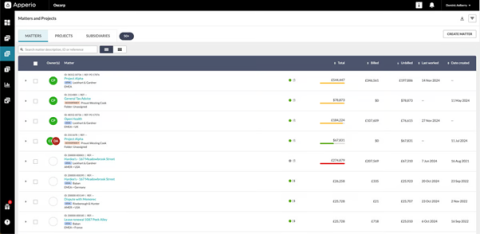

Leading legal teams take a different approach. Instead of waiting for invoices, they focus on live spend management—tracking legal costs as they accrue to stay ahead of potential issues and ensure that budgets stay on track.

Let’s look at some scenarios to see the difference…

Example #1: M&A transaction

Imagine a legal team budgeting £200,000 for an M&A transaction. With invoicing software alone, they don’t see costs until the invoice arrives—£250,000, well over budget. At this point, their options are limited: dispute the fees (risking friction with the law firm), seek internal budget approvals (frustrating finance), or absorb the cost.

Now, contrast this with a legal team continuously monitoring legal spend. Midway through the matter, they notice a spike in billed hours from senior partners, with total costs already at £150,000—far ahead of schedule. With this insight, they step in early, adjust staffing allocations, and ensure more work is handled by mid-level associates, bringing costs back in line before the invoice is issued.

With the new approach, firms prevent budget overruns instead of reacting to them.

Example #2. Unexpected litigation costs

Imagine a legal team handling a high-stakes litigation matter with an estimated budget of £500,000. They expect steady costs over several months, but with invoicing software alone, they don’t get visibility into costs until invoices land.

By the time the first invoice arrives—£175,000 in the first month alone—they realize costs are tracking far above expectations. But at this point, it’s too late to adjust. The work has been done, the hours have been billed, and now they’re left with tough decisions:

- Dispute the fees, potentially damaging relationships with outside counsel

- Seek additional budget approvals, adding internal friction with finance

- Absorb the cost, putting pressure on the legal team’s overall budget

Now, contrast this with a legal team using real-time spend management.

After just a few weeks, they spot unexpected cost spikes in expert witness fees and unplanned motion filings—expenses that are accumulating faster than anticipated. With this insight, they act early:

- Reassess case strategy, eliminating non-critical motions to manage costs

- Negotiate expert witness fees, ensuring costs stay aligned with the budget

- Maintain control over spend, avoiding end-of-matter budget surprises

By tracking costs as they accrue, the legal team prevents a budget crisis before it happens—ensuring the litigation remains on course financially without last-minute panic.

Smarter legal spend starts before the invoice

legal invoicing and e-billing software is an essential tool for managing billing workflows, reducing administrative burdens, and improving compliance. But it’s not a solution for spend control—it’s a system for processing costs that have already been incurred.

For legal teams that want to avoid budget surprises, waiting for invoices isn’t enough. The key is to track legal spend as it happens, identifying risks before they turn into overspend. By combining legal invoicing and e-billing software with tools that allow you to continuously monitor legal spend data, legal teams move from reactive cost approvals to active budget control—ensuring they’re always in command of their legal spend, not just their invoices.

Want to gain real control over your legal spend? Learn how leading legal teams are staying ahead of costs, before invoices arrive, with Apperio. Book a demo.