Why legal AI tools belong in the boardroom (not just legal ops)

AI is gaining traction in legal departments, particularly for tasks like contract analysis, document review, and due diligence. But there’s a deeper, often overlooked benefit that deserves attention from the boardroom.

Legal AI tools are starting to surface the kind of data that legal and finance leaders have historically struggled to access—continuous legal spend oversight, emerging risks, and operational bottlenecks. These are the same levers executives use to manage performance, control costs, and accelerate deals.

With the right tools in place, the insights generated through day-to-day legal work can inform forecasting, budgeting, and even strategic planning—long before an invoice is sent.

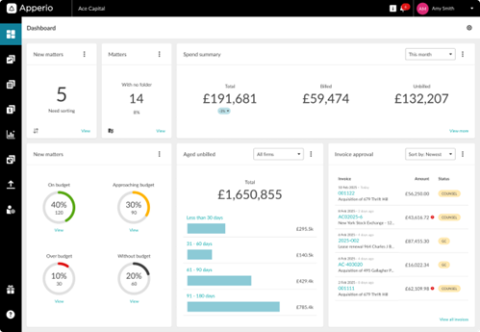

In this post, we’ll look at how legal AI tools, like Apperio, are helping legal and finance teams make smarter decisions, and why those insights should be shared far beyond legal ops.

» New to Apperio? It's legal spend management software that lets you focus on what matters. Connect your law firms, access real-time data, and leverage AI to manage both billed and unbilled legal work. Change how you monitor, control, and optimize legal spend—reducing costs by up to 18%. Sign up for a demo.

Why legal AI tools matter to more than just legal teams

Legal teams already manage some of the most business-critical work: disputes, contracts, transactions, compliance. In doing so, they generate a wealth of data—who’s working on what, how matters are progressing, how costs are tracking, and where potential risks are building. But in many businesses, that data doesn’t travel far beyond legal ops.

It’s not because it lacks value. It’s because the tools to surface and share it in a useful, timely way haven’t always been available.

Legal AI tools are starting to change that. By combining in-progress data with GenAI-powered analysis, platforms like Apperio Insights make it possible to ask simple, high-value questions—without needing to run manual reports or wait for invoice data. For example:

- Which matters are trending over budget this quarter?

- Are we seeing delays in similar matter types across firms?

-

What’s driving the increase in litigation spend year-on-year?

This kind of visibility helps legal teams spot issues early. But just as importantly, it gives finance leaders, deal teams, and other decision-makers a clearer understanding of what’s happening, while there’s still time to take action.

The three insights legal AI tools can surface—before the invoice lands

Legal spend is often viewed retrospectively. By the time reports are compiled and invoices reviewed, decisions have already been made, and opportunities to intervene have passed. That’s where legal AI tools, especially those working off in-progress data, offer a meaningful advantage. They give legal and finance teams early visibility into three key areas that shape business outcomes: cost, risk, and speed.

#1. Cost: What’s being spent and what’s likely to go over budget

Traditional spend reports can tell you what’s already been billed. But by that point, correcting course is difficult. Legal AI tools like Apperio Insights provide a live view of unbilled work, tracking changes as they happen and flagging unusual patterns. For example, the system can alert users when WIP is trending above expected levels, or when time is being recorded inconsistently across similar matters.

This allows legal and finance teams to step in early, clarify scope, and prevent overrun—without waiting for a final invoice or trying to retrospectively challenge fees.

#2. Risk: Where exposure is building across portfolios

Legal matters often carry underlying risks that don’t show up in a spreadsheet. Delays, overstaffing, inconsistent resourcing, or repeated scope changes can all signal issues that affect deal timing or business performance. Legal AI tools help surface these patterns across firms, matter types, or portfolios—giving deal teams and finance leaders earlier visibility into areas of concern.

It’s not about replacing professional judgment. It’s about making the signals clearer and easier to act on.

#3. Speed: How quickly matters are progressing and what’s slowing them down

For deal teams, time is often the most valuable resource. The ability to spot matters that are stalling, dragging on, or being handled inefficiently is critical to maintaining momentum.

AI tools can highlight where progress is slower than expected, where fee earners are stacking up, or where a matter is taking significantly longer than others in its category. That information helps teams make smarter resourcing decisions and avoid timeline surprises.

Making legal intelligence accessible: Who needs it and why

Even when legal and finance teams have the right data, acting on it isn’t always straightforward. Reports can be delayed. Analysis may rely on a small number of people with specialist knowledge. And sometimes, questions go unanswered simply because no one has the time to pull the numbers.

Legal AI tools change that by making insights easier to access—and easier to use. Platforms like Apperio Insights are designed to remove friction. Instead of waiting for a scheduled report or needing to dig through spreadsheets, users can ask direct questions and get clear answers in plain language.

This opens up legal data to a wider group of people—not just legal ops or finance analysts, but also deal teams, CFOs, and operational leaders who need visibility to make decisions quickly.

When everyone is working from the same up-to-date view of legal spend and matter progress, collaboration improves. Conversations happen earlier. And decisions are made with far more confidence.

> Read more: What is Apperio Insights? GenAI legal spend management for faster decision-making

The potential of legal AI tools: Beyond cost management

For private equity firms and corporate legal departments, legal spend has traditionally been viewed as a necessary overhead. But the data generated through legal work contains strategic value that extends beyond matter management.

When legal AI tools surface this information efficiently, legal departments transform from cost centers into sources of business intelligence. This shift has particular significance for organizations managing complex deal portfolios or multiple jurisdictions.

Consider these strategic applications:

- Portfolio management: Identify which types of investments consistently generate higher legal costs or longer deal-closing timelines, allowing for more accurate financial modeling.

- Firm selection: Move beyond hourly rates to evaluate legal partners based on efficiency metrics, timeline adherence, and success rates.

- Risk forecasting: Recognize patterns in legal activity that correlate with specific business outcomes or regulatory challenges.

Here’s what you need to make this work…

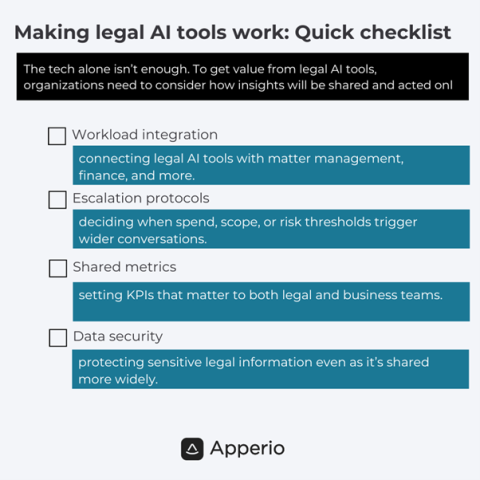

Making legal AI tools work: Quick checklist

The tech alone isn’t enough. To get value from legal AI tools, organisations need to consider how insights will be shared and acted on.

That means thinking about:

⬜Workflow integration: connecting legal AI tools with matter management, finance systems and dashboards

⬜Escalation protocols: deciding when spend, scope or risk thresholds trigger wider conversations

⬜Shared metrics: setting KPIs that matter to both legal and business teams

⬜Data security: protecting sensitive legal information, even as it’s shared more widely

The most effective teams build regular forums where legal, finance and operations review these insights together—so legal data becomes part of the bigger picture, not left in isolation.

Why legal AI tools are becoming boardroom necessities

The current generation of legal AI tools focuses primarily on making existing data more accessible. But the next evolution is already underway: predictive analytics that forecast outcomes based on historical patterns.

For legal and finance teams, this capability will modernize planning and resource allocation. Instead of reacting to developments, organizations will anticipate them:

- Predicting which matters are likely to exceed budget based on early activity patterns

- Forecasting the probable timeline for regulatory approvals based on jurisdiction and matter type

- Identifying which transaction structures correlate with smoother closing processes

These predictive capabilities represent the next frontier in legal AI—moving beyond retrospective analysis to forward-looking intelligence that shapes strategy before decisions are made.

Ready to make legal spend more predictable—and more valuable? See how Apperio helps legal and finance teams surface the insights that matter, before the invoice land. Book a demo.