Boosting cost control: the way you use Alternative Fee Arrangements matters

Legal fee structures are changing. The traditional billable hour is increasingly being augmented—or even replaced—by Alternative Fee Arrangements (AFAs).

Now, on average 23%* of all external legal spend is on AFAs (according to Bloomberg).

Why?

As businesses seek greater predictability in their legal expenditures, AFAs are the way leading firms enhance budget control and ensure that costs align with the value received. This shift reflects a broader trend towards more transparent and mutually beneficial client-lawyer relationships.

In this blog, we’ll cover all things related to AFAs—from understanding the different types of arrangements available to how they can lead to the more strategic use of legal services. We’ll also talk you through how legal spend management software plays a key role in implementing and managing these arrangements effectively.

Let’s get started.

What are Alternative Fee Arrangements (AFAs)?

Traditional hourly billing models often result in unpredictable legal costs and can create a misalignment between the time spent and the value delivered to clients. Whereas Alternative Fee Arrangements (AFAs) offer a different approach—providing more certainty over cost and often an outcome-driven approach to legal billing.

Advantages of AFAs:

🔮Cost predictability: AFAs, when used effectively, provide a clear understanding of legal expenses from the outset. This transparency allows for more effective budget management and financial planning, enabling firms to allocate resources more efficiently.

🔗Aligned expectations: By moving away from the traditional billable hour model, success-based AFAs can encourage legal partners to focus on the quality of the outcomes rather than the number of hours. This creates a stronger partnership where the law firm's incentives are directly tied to our objectives, ensuring a more aligned approach to achieving successful legal and business outcomes.

📈Efficiency incentives: AFAs can incentivize outside counsel to work more strategically and efficiently, by carefully planning budgets. This can reduce overall legal costs as law firms are motivated to resolve matters effectively and expediently. The efficiency driven by AFAs directly benefits operations, allowing firms to streamline processes and improve the bottom line.

🔍Transparency and trust: The straightforward nature of AFAs simplifies the billing process, making it easier to understand and plan for costs. This increase in billing transparency enhances trust and satisfaction in relationships with law firms, contributing to more open and honest communications and longer-term partnerships.

Let’s now look at the types of AFAs and how they work.

Types of AFAs for legal spend management

Here are the popular forms of AFAs:

> Fixed fee arrangements

Fixed fees involve one set price for a specific legal service or project, agreed upfront. This arrangement is valued for its simplicity and predictable costs, encouraging firms to budget accurately.

Advantages:

✅ Cost certainty: Clients get more predictability over what they’ll pay, making financial planning more straightforward.

✅ Simple billing: These contracts simplify the billing process, making it easier to understand and plan for legal fees.

✅ Focuses on value: This setup incentivizes law firms to prioritize efficiency and sticking to scope, because if they underspend on the work they are rewarded with the difference to the agreed fixed fee.

Best for:

💡 Repeatable work such as contract drafting: Ideal for services with a clear and predictable scope, ensuring budget adherence and competitive pricing.

💡 Routine legal work: Effective for standardized processes such as regular compliance checks, where outcomes are well-defined.

Risks:

For more complex types of legal work, such as litigation or M&A, fixed fees are less effective as the scope is less predictable. This can lead to reduced quality, and unexpected overruns as additional fees are incurred for out-of-scope work.

> Capped fee arrangements

Capped fees set a maximum amount that can be billed for a matter, which is then worked and charged as normal. This protects firms against unexpected cost overruns while accommodating the complexities of more involved legal tasks.

Advantages:

✅ Cost control: Avoids budget overruns, especially for some complex and variable legal matters.

✅ Flexibility: Provides law firms with the flexibility to adapt their strategies as necessary, while keeping costs within an agreed limit.

✅ Shared risk: Shows the law firm's commitment to managing costs efficiently, aligning with the firm’s interests.

Best for:

💡 IP and trademarks work: Where you want to avoid any unexpected overruns

💡 One-off / low priority matters: Ideal for scenarios where cost overruns are more damaging than slower outcomes

Risks:

Because there is less upside for law firms than with capped fees, there is less incentive to work efficiently. If law firms hit the cap, they will typically need to stop work which can affect outcomes or cause delays

> Success fee arrangements / Contingency fee arrangements

This arrangement hinges on outcomes, where payment depends on achieving specific legal results–for instance, hitting a particular milestone or securing a result. They are often used in disputes and litigation work, and are sometimes tied to the size of the settlement.

Advantages:

✅ Outcome-focused: Businesses pay based on results, which aligns both parties towards a common goal.

✅ Motivation for efficiency: Law firms are incentivized to work diligently to achieve the desired outcome as their fee depends on success.

✅ Financial flexibility: Reduces upfront costs for businesses, providing access to legal services without an immediate impact on cash flow.

Best for:

💡 High-stake cases: Ideal for situations where the potential for a significant payoff exists if the case is won.

💡 Complex litigation: Useful in scenarios where businesses want to minimize upfront spending while working towards a favorable settlement.

Risks:

These arrangements aren’t suitable for all types of work, and can create additional risk for your law firms. Alignment of the incentives is important so that the work reflects your needs.

Where legal spend management software comes in

Legal spend management software makes it easier for businesses to use and manage AFAs, like fixed or capped fees.

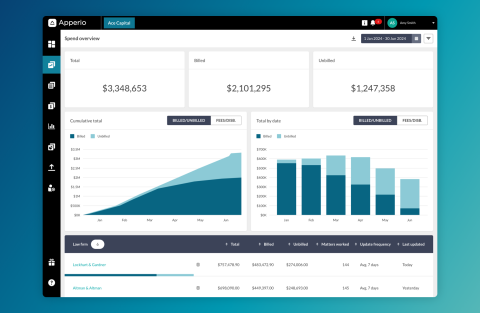

These smart tools—like Apperio—enable you to track all the AFAs you have in progress, and ensure they deliver value for you. Here’s how:

- Centralized view of all matters: See all your matters and spend, whether fixed, capped or hourly, in one place.

- Get insight into the work as it progresses: Ensure that the AFA delivers value, and stays ahead of any issues or scope creep in real-time.

- Enhanced forecasting capabilities: Leveraging historical spending data and real-time tracking to enable more accurate projections of future legal costs and more effective buying of legal services.

- Strategic and data-driven insight: This allows you to select the most effective fee arrangements for your matters with the best intel, enabling optimized spend by law firm, region, and matter type.

To really benefit from this, there are certain key features to look out for.

Must-have features:

- Real-time budget monitoring and alerts: Continuously monitor fees with real-time alerts when spending nears or exceeds set thresholds. Prevents overruns and allows tracking of adjustments and a log of any changes to help control scope creep.

- Benchmark spending against peer companies: Gain visibility into market rates for different types of legal work under AFAs and understand where your firm may be overspending or where you are getting exceptional value.

- Staffing efficiency analytics: Track how efficiently work is done, so you can understand how accurately the work was priced.

- Collaboration: Ability to communicate with your law firms or professional services firms within an application to encourage effective collaboration.

- Project roll-up: Combine multiple AFA’s, or time and materials, or other professional services spend for a project and track it against central budgets.

- Contract management: Input and track detailed AFA terms like fee structures, milestones and caps. Maintains an organized record for easy reference.

By leveraging these user-friendly capabilities, legal spend software simplifies AFA management while optimizing how legal services are strategically deployed. This enables firms to receive high-quality, cost-effective legal support.

Let’s now pull all these together with the key takeaways. 👇

The future of smarter legal spending with AFAs

Alternative Fee Arrangements can offer a better way for businesses to manage legal costs on certain matters. By moving beyond the traditional hourly billing model, AFAs provide:

- ✅ Predictable legal expenses through fixed fees and capped fees

- ✅ Better cost predictability by rewarding efficiency of work

- ✅ Stronger alignment on value between you and your law firms

Legal spend management software is a must-have for effectively implementing and overseeing AFAs. Key capabilities include:

- Detailed tracking of what AFAs are agreed and how they actually perform

- Continuous budget monitoring with automatic overrun alerts

- Analytics on staffing mix, efficiency and work quality metrics

Put simply, this technology simplifies AFA management while optimizing value for law firm partnerships. What’s more, leveraging integration with financial systems plus advanced analytics—found in software like Apperio—enables:

- A real-time, unified view of all legal spending across portfolios

- Data-driven selection of optimal AFA pricing models

- Negotiating the most favorable AFA rates based on market benchmarks

So, as pressure mounts for cost transparency, adopting AFAs backed by strong spend management tools sets firms up for success. Firms maximize legal budgets' efficiency and value while getting high-quality services aligned with investment goals.

Ready to get started with legal spend management software? Book a demo and our experts will take you through how Apperio allows you to manage AFAs.

Source: https://pro.bloomberglaw.com/insights/legal-operations/legal-ops-and-tech-survey/